Passive Pools

Introduction

No liquidations. No impermanent loss. Isolated and fully collateralized.

Passive pools form the supply side of the Adrastea Protocol’s lending market, where assets are provided for borrowing by Boost positions.

What about yield?

Boosters (borrowers) are charged interest rates based on the utilization curve. As the liquidity in the pools is increasingly utilized, the interest rate rises accordingly. This mechanism is comparable to other lending protocols.

Let’s explore this in more detail:

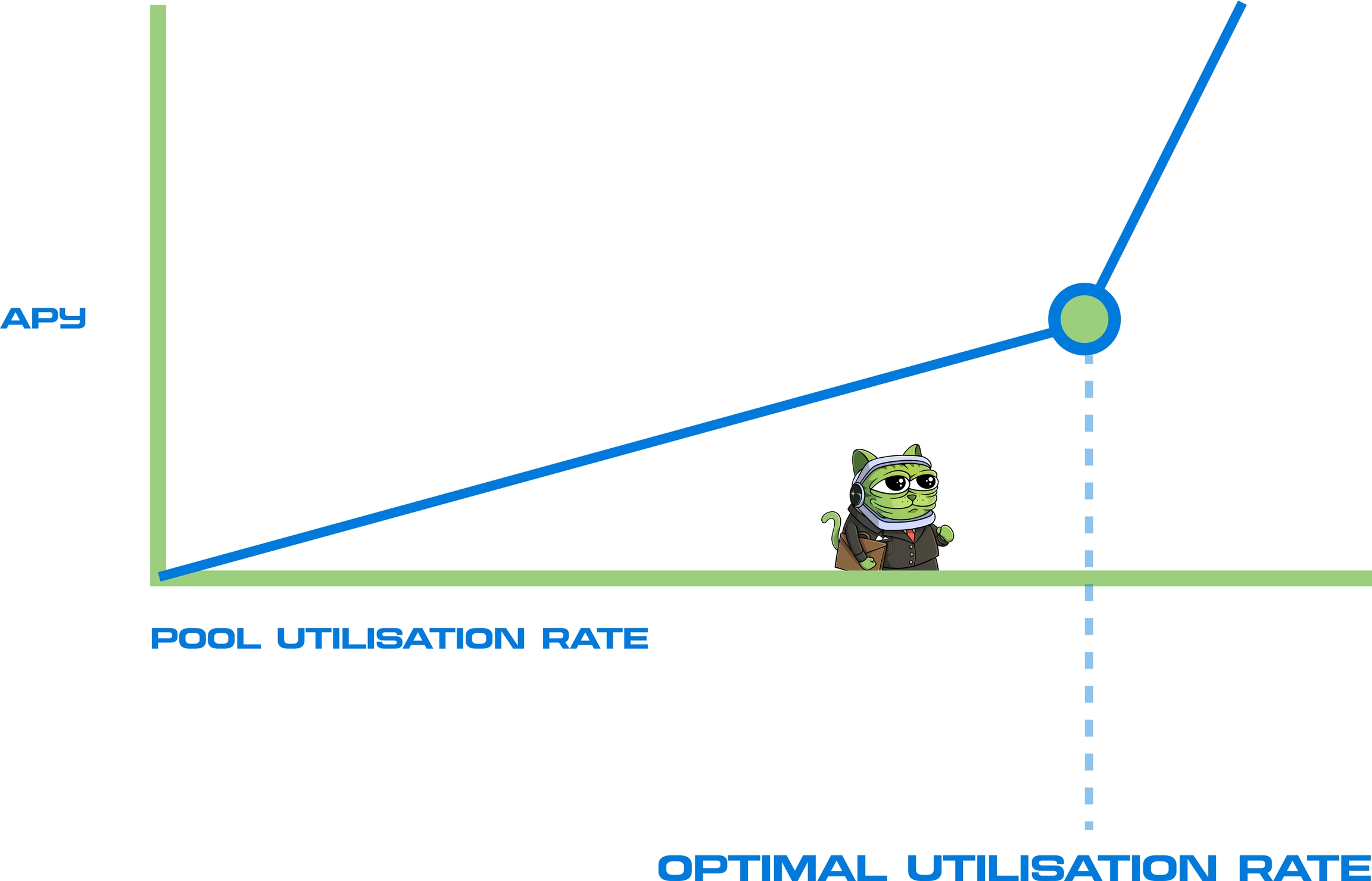

The lending rate mechanics: each asset pool supply rate features two slopes centered around an inflection point, which is the protocol-determined optimal utilization rate. Initially, the supply rate increases gradually as the utilization rate rises. However, once the utilization rate surpasses the inflection point, the rates increase significantly.

Interest Rate Formula

The protocol operates with two slopes to reach an inflection point, which corresponds to a target utilization rate at a specific predefined APY. For each asset, this target APY is tracked against the market average to ensure pool rates remain competitive.

Parameters:

a and b: Coefficients for the linear part

k and m: Coefficients for the exponential part

U_{threshold}: The utilization threshold where the change occurs.

Below a certain utilization threshold U_{threshold}:

The interest rate increases linearly with a slope a and an intercept b.

Above the utilization threshold U_{threshold}:

The interest rate increases exponentially with a base of e, scaled by k and an exponent factor m.

Formula: Represents the interest rate based on utilization, with a linear increase below the threshold and an exponential increase above the threshold.

Example: USDC pool at 12% APY at target 80% utilisation.

Looking at USDC example protocol initiates minimum borrow APY at 5% and target APY at 80% pool utilisation at 15%, the formula above is being established. The minimum borrow APY and target APY are continuously monitored and adjusted to remain competitive with the market.

Assets Withdrawal from the Pools

Depending on the pool’s utilization ratio, not all liquidity may be withdrawable at once if the utilization is high. This doesn’t indicate that the protocol has lost money or is insolvent; it simply means the liquidity is being utilized in the Boosts. When available liquidity is low, the APY increases to attract more capital providers and achieve equilibrium. This mechanism is standard among lending protocols like Compound and Aave. Adrastea DAO will be able to adjust the utilization curve parameters to influence protocol behavior in unusual situations.

Last updated